Latest News

| Commodity Options | ||

|

|

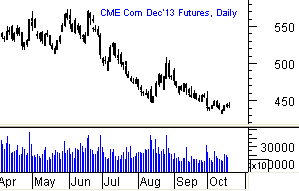

Opportunities in CME Corn Futures

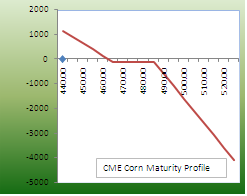

The bear trend in Corn for nov'13 options maturity did offer some opportunities to stay net short in calls and at the same time stay short in deep out of the money puts as well. the salient features of this strategy is to

The result of this strategy was that after it was suggested on Sep-24, we could see a net return of 15 cents from this Strategy. the benefit in considering options as a part of your portfolio is that some times like these when the price falls at a diminished rate of change being net short in the options provides better opportunities than being futures short.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Bank Rates

| Currency | Centeral Bank Rate | Overright Rate |

AUD AUD |

2.75% | |

NZD NZD |

2.50% | |

EUR EUR |

0.50% | 0.45% |

CAD CAD |

1.00% | |

GBP GBP |

0.50% | 0.48% |

USD USD |

0.25% | 0.12% |

- Economic Calender

| Date | Event | Actual | Forecast |

|

Jul 30

|

USA Cons Confidence |

81.40 | |

|

Jul 31

|

USA Adv GDP Q/Q | 1.8% | |

|

Aug 02

|

USA NFP | 195K |

Free Newsletter