Latest News

ICE sugar broken out of the falling wedge ... bullish trend to begin? or just an abberation to a prolonged consolidation?

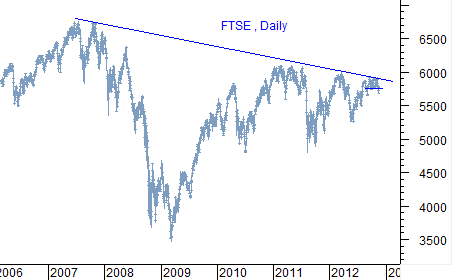

| Major Stock Indices | ||

|

- Bank Rates

| Currency | Centeral Bank Rate | Overright Rate |

AUD AUD |

2.75% | |

NZD NZD |

2.50% | |

EUR EUR |

0.50% | 0.45% |

CAD CAD |

1.00% | |

GBP GBP |

0.50% | 0.48% |

USD USD |

0.25% | 0.12% |

- Economic Calender

| Date | Event | Actual | Forecast |

|

Jul 30

|

USA Cons Confidence |

81.40 | |

|

Jul 31

|

USA Adv GDP Q/Q | 1.8% | |

|

Aug 02

|

USA NFP | 195K |

Free Newsletter