|

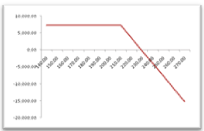

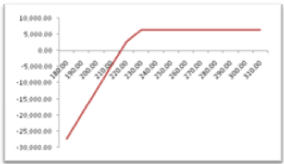

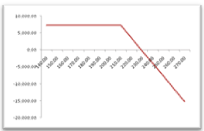

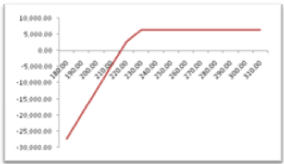

Covered Put

|

|

| Strategy |

Sell Put OTM strike, Sell Futures at market |

| Utility |

Limits some losses arising out of short futures. |

| Critisism |

Neither short put nor short futures serves as a hedge to each leg of trade and may eventually expose to huge losses. |

|

|

|

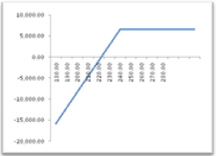

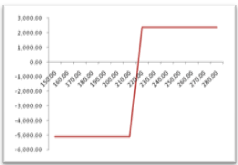

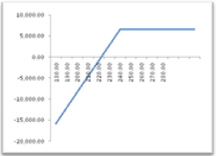

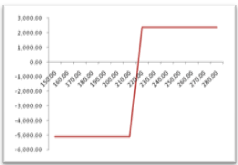

Covered Call

|

|

| Strategy |

Sell Call OTM strike, Buy Futures at market |

| Utility |

Limits some losses arising out of Long futures. |

| Critisism |

This strategy leaves limites revenue potentials but exposes to enormus losses should the price trend weaken. |

|

|

|

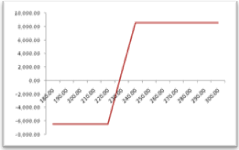

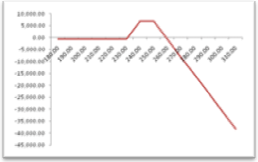

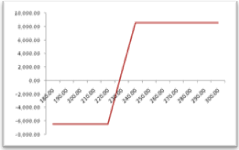

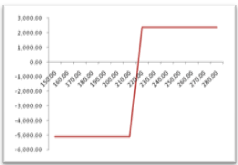

Collars

|

|

| Strategy |

Buy Futures,

Buy ATM put

Sell OTM call |

| Utility |

Puts bought insures a falling futures price and the calls sold finances cost of puts. A mild bullish strategy , can be traded at a lower end of a range. |

| Critisism |

With a limited down side and limited upside, this strategy is no different than bull call spread. Added to this, the margin requirements and cost of transaction can be high, which inturn efects profitability. |

|

|

|

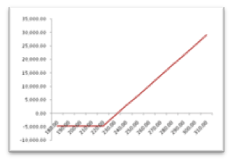

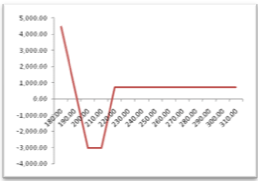

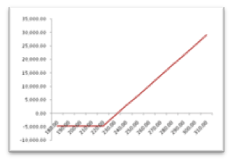

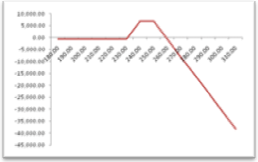

Long Straddle

|

|

| Strategy |

Buy put ATM

Buy Call ATM |

| Utility |

At times of low volatility, price move in either direction can fetch some revenue. |

| Critisism |

Expensive, give the fact this strategy requires long position in both direction and in case price dosent move at all then the costs of the options do not get recovered. |

|

|

|

Synthetic Call

|

|

| Strategy |

Buy put OTM

Buy Futures ATM |

| Utility |

A proxy to buy call. In case of price trend sharply beyond a resistance, then the long put can be exited leaving alone , the long futures trade |

| Critisism |

Limits losse no doubt, but the profit potentials suffer in case price trades range bound. |

|

|

|

Synthetic Put

|

|

| Strategy |

Buy call OTM strike

Sell Futures at market |

| Utility |

A proxy to buying naked puts. Can be potentially useful in case price falls beyond an important support |

| Critisism |

Needs a sizeable move inorder to be profitable and the profit potentials suffer in case price trend range bound |

|

|

|

Covered Short Straddle

|

|

| Strategy |

Sell Call ATM

Sell Put ATM

Buy futures ATM |

| Utility |

In case of a positive divergence seen in a security selling straddle and buying futures can provide some benefit on the upside. |

| Critisism |

With a sizeable risk in hand, this strategy demands to sell futures in case price falls drastically. |

|

|

|

Covered Short Strangle

|

|

| Strategy |

Sell call OTM

Sell put OTM

Buy futures ATM |

| Utility |

This strategy can be less risky than covered short straddle for the fact that strikes farther the spot are sold. |

| Critisism |

Although selling farther strikes from spot, can give some cushon for adjustments this strategy may leave open to potential losses and limited profits. |

|

|

|

Bull Call Spread

|

|

| Strategy |

Buy call OTM

Sell call OTM (higher strike than buy side). |

| Utility |

In case a trader wants to limit his losses and at the same time trade with a calculated profits then the call spread can serve the purpose. |

| Critisism |

In case market moves strongly in favour of the strategy, then the profit potentials can be very thin. |

|

|

|

Bull Put Spread

|

|

| Strategy |

Sell put OTM

Buy put OTM (strike lower than sold) |

| Utility |

Sell puts can earn revenue in case price trend remains positive. Long put can serve as a hedge against the naked puts sold. |

| Critisism |

The entire strategy rests on earning from sell put and the long puts can only serve as a hedge for naked puts sold in case of a sharp price fall. |

|

|

|

Bear Call Spread

|

|

| Strategy |

Sell call OTM

Buy call OTM( Strike higher then sold) |

| Utility |

Sell calls earns revenues in case price remains bearish and the long calls bought at higher strike can serve as a hedge to the calls sold. |

| Critisism |

The entire strategy rests on calls sold after recovering costs of options bought. The profit potentials can be thinner in case of low volatilites where the option price itself is low. |

|

|

|

Bear Put Spread

|

|

| Strategy |

Buy Put OTM

Sell Put OTM ( strike lower than bought) |

| Utility |

Can provide a limited profit and loss potentials usually in the ratio of 1:2 |

| Critisism |

The long options more often than not, gets effected by theta. Hence if a price trend strongly in the favour of the strategy, the profit potentials can be constrained. |

|

|

|

Bull Call Ladder

|

|

| Strategy |

Buy call OTM (X1)

Sell call OTM (Middle lower)

Sell call OTM (lower) |

| Utility |

This can be an extension of the bull call spread with an additional call sold at a higher level then the first call sold. |

| Critisism |

By taking double the risk of financing the options bought any adverse price move on the upside can result in huge losses. |

|

|

|

Bull Put Ladder

|

|

| Strategy |

Sell put OTM (X1)

Buy Put OTM (Middle higher)

Buy put OTM (higher) |

| Utility |

An extension of the bull put spread where an additionl put bought below the first put bought can enhance the profitability. |

| Critisism |

In case price fails to fall lower the entire profit potentials rest of the puts sold. |

|

|

|

Bear Call Ladder

|

|

| Strategy |

Sell call OTM (X1)

Buy Call OTM (middle higher)

Buy call OTM (higher) |

| Utility |

Enhances profitability in case prices rally. In case the price dosent rally then the calls sold close to the market can earn some premium. |

| Critisism |

The entire potentials to earn can rest with the calls sold in case price dosent rally beyond the strikes bought. |

|

|

|

AUD

AUD NZD

NZD EUR

EUR CAD

CAD GBP

GBP USD

USD